HBO has a new series that debuted Sunday titled Ballers. In it Dwayne Johnson stars as fictional former NFL player Spencer Strassmore, and Rob Corddry plays Joe, the so-far-unlikeable financial advisor who has hired him to monetize his football friendships. If the the pilot is any indication, this show will […]

A common strategy for brokers, financial advisors, and investment managers is the use of Dollar-Cost Averaging (DCA). This is the practice of buying a set dollar amount of an investment or basket of investments at a pre-determined interval over a pre-determined length of time. So, for example, instead of buying […]

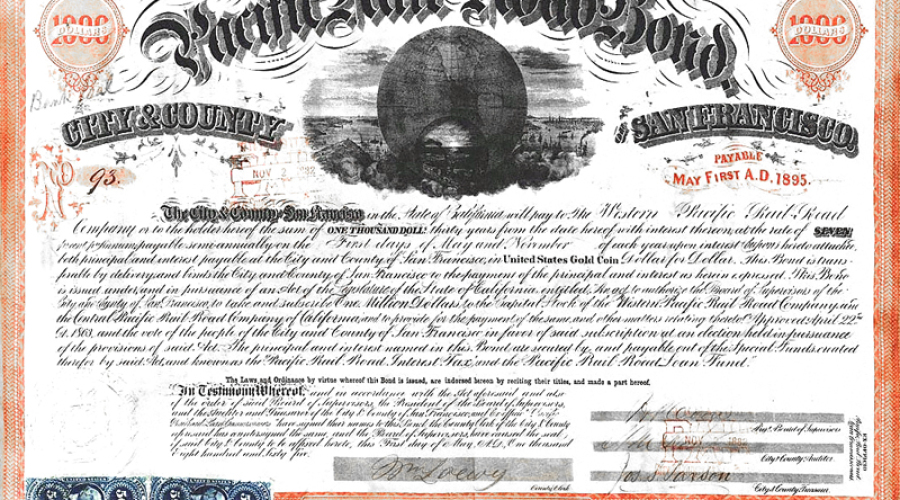

There is a place for bonds in almost every portfolio. Even if you have an aggressive investment strategy that focuses exclusively on potential capital appreciation, a small allocation to bonds can noticeably reduce overall volatility in a portfolio without sacrificing much, if anything, in the way of returns over the […]

Socially Responsible Investing (SRI) is an approach that looks beyond just financial returns when evaluating an investment, and also considers social, environmental, or other ethical concerns. It can mean vastly different things to different investors. If you are Catholic it might mean avoiding Johnson & Jonson (ticker: JNJ) because they […]

Choosing what type of accounts to use to save for retirement and how to prioritize their funding can be confusing. Below is a basic decision tree to hopefully make the process a little easier. Self-employed people and certain others have situations that are more complex, but this is an appropriate guide for […]

One-nights stands, in my opinion, are perfectly fine if both parties understand what it is and nobody is misleading anyone. Much the same, investing in leveraged ETFs can be exciting as long as you understand exactly what to expect and know going in it’s not for the long-term. Otherwise, if you […]

Two very close friends of mine had their first child last week — a healthy and quite adorable baby girl! I met her for the first time at the hospital, and just 17 hours after she was born Mom and dad were already talking about planning for baby’s education. Never […]

“I’m proud to be paying taxes in the United States. The only thing is — I could be just as proud for half the money” -Arthur Godfrey Tax evasion — the act of deliberately misrepresenting your income, overstating deductions, hiding money and investment gains offshore, and in general lying to […]

Remember back when gas was $3.70, Jeremy Clarkson was still on Top Gear, and One Direction was a crappy five-member boy band instead of a crappy four-member boy band? 2014 seems so long ago for most of us, but for contributions to your IRA account that year is still alive. […]

Sorry I couldn’t think of a more eloquent word than that. I’ve just met too many so-called “advisors” out there that lack the knowledge, discipline, and ethics I believe clients deserve. The truth is a lot of brokers or financial advisors — or whatever their marketing groups are telling them […]