The answer is no, because bitcoin requires a functioning global network and a reliable power supply, and everything I’ve learned from zombie movies tells me those things won’t be around long. To be fair, cash or credit cards wouldn’t help you in this scenario either. But I have so many […]

One summer, maybe ten years ago, I was sitting out on the deck of the Downtowner Lounge in Houghton, MI sharing a few laughs with good friends. We were enjoying the summer day with 2-for-1 beers and double cocktails, with the lift bridge that spans the Portage Canal serving as […]

Former Defense Secretary Donald Rumsfeld somewhat famously — at least in financial nerd circles — sends a letter to the IRS every year on Tax Day railing against the complexities of the U.S. tax code. Last year’s letter included this: Despite having performed this civic duty for over half a […]

’Twas the day of the election, when all through the exchange, not an asset was trading, outside a tight range. The polls all showed, and the media was sure, that America would certainly, be voting with “Her”. The city folk were nestled, in front of their TV, while visions of […]

Wells Fargo was hit with a $185 million fine Thursday for widespread illegal sales practices that involved opening over 2 million fake accounts without customers’ knowledge. The U.S. Consumer Financial Protection Bureau’s $100 million portion of that fine was the largest ever in the agency’s five-year history. The CFPB said […]

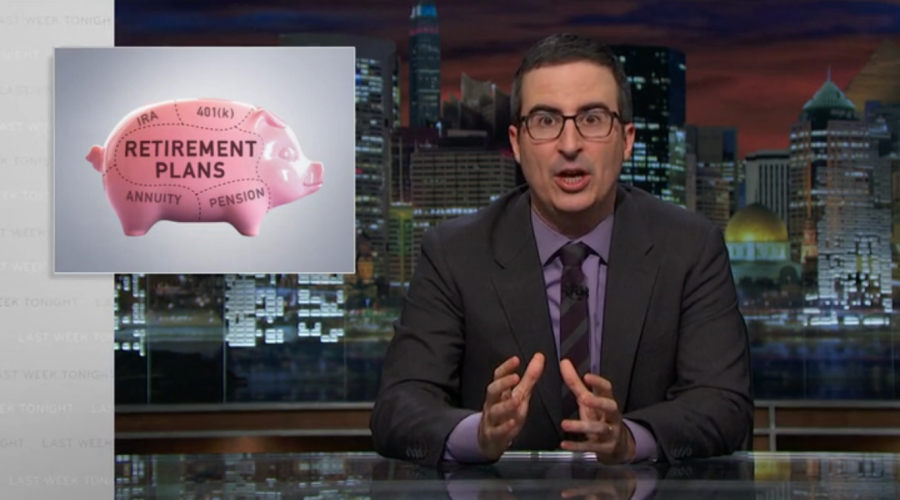

Last Week Tonight with John Oliver has, in my opinion, a great track record for showcasing forgotten or ignored issues that defy common sense, and then ripping the systems that create or sustain them to pieces with blue comedy that still manages to be charming thanks to his British accent and […]

My parents will be turning 62 next year, and I don’t think they’ve been this excited about a milestone since their 18th birthdays. They cannot wait to start collecting early Social Security benefits. And I am trying my hardest to stop them. Some of the best loopholes for maximizing your Social Security […]

We human beings are a myopic bunch when it comes to investing. It’s not our fault; we’re wired to run to safety in times of trouble. Unfortunately it causes us to worry about the day-to-day movements of the market when they have virtually no impact on things over the long-term. […]

Click here to read the latest issue of our quarterly investment newsletter.

Recently, a client asked me what I thought about a video that was making its way around Facebook a few weeks ago demonstrating the power of investing early. I can’t find it anymore, but the basic premise was something along the lines of if you invested just $2,000 each year in […]